London Accountant & Dad-of-2, Ken Okoroafor Highlights How He Went From Being a Shop Assistant To Financial Freedom

At the age of just 34, dad-of-two, Ken Okoroafor can retire any time he chooses.

The Nigerian-born saver went from a Topshop assistant to a debt-free chartered accountant in just over 10 years.

He started saving in 2006 on a £26,000 salary and says anyone, no matter their current wage, can do the same with a few simple lifestyle changes.

READ ALSO: FAMILY FINANCE: 7 Ways To Create A Budget That Really Works

A few of his savvy tips include: buying an electric car, shopping in Aldi, cutting out red meat, buying a house somewhere cheap and commuting to work, planning ‘big purchases a year in advance’ and banning electronics from the home.

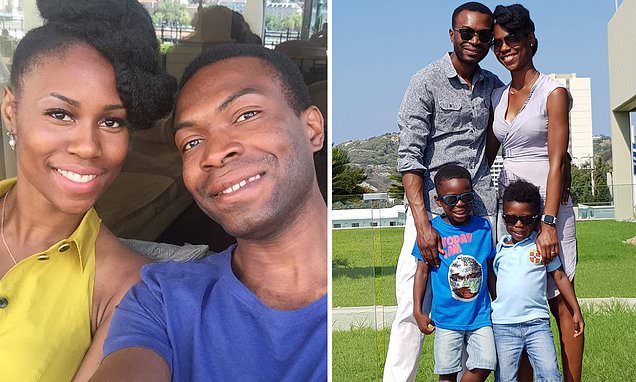

Ken Okoroafor pictured above with wife, Mary, 34, moved to London from Lagos, Nigeria; at 14 with no savings.

“It’s possible for anyone to achieve early retirement within 20 years, but they’ll need be ready for a big lifestyle change.”

“In terms of numbers, I’d typically tell people to aim to save 25 times their annual expenses to achieve financial independence.”

“They should aim to put away 50 per cent of their wage every month. I started using that technique in 2009 when I met my wife.”

“Then they need to start thinking big picture. Where do they live? Can they move somewhere cheaper?”

“Anyone looking to save needs to be ready to cut out luxuries like that. I drive a second-hand 2013 Nissan Leaf, which is electric and very low cost.”

“We charge the car at home and have a limit on our electricity every month, so we don’t overspend.”

“Before making any big purchase – like a car- try think ahead. Try to plan the big purchase about a year in advance so that you can budget for it.”

“Buy a car that’ll last you for years. And don’t get it on finance, make sure you’re not increasing your monthly expenses.”

Okoroafor said his humble beginnings taught him to appreciate money and do without luxuries.

“I learned to save through values passed on by my parents. My mother and father were immigrants and we were forced indirectly to save, to make sure we had enough to get by the following day.”

“I think modern society makes people think they need the latest car or phone. But the truth is they don’t.”

READ ALSO: 8 Ways to Keep Your Family on a Budget During this Economic Recession

“We feed our family-of-four on £50 per week. We shop at Aldi. Kids can be notoriously expensive but we don’t have iPads and other electronics in the house.

Okoroafor worked in Topshop while studying Economics and Accountancy at City, University of London, to pay off his student fees.

While he acknowledges that the cost of studying nowadays is higher than when he was in education, he still advises students to work a job around their studies.

“I didn’t take student loan when I was at university. Even at that young age I knew I didn’t want to be in debt. I got a part time job at Topshop where I’d work at the weekend. It paid for my £1100-a-year study fees.”

The self-made saver offers a guide on how much money you should be saving on his website The Humble Penny.

He stressed that while his methods can help people achieve early retirement, he would rather promote “financial independence.”

“I think working is important for individuals and communities. I want people to have financial freedom and the option to retire early. But I’d like to encourage people to keep working. Find a job that they love. Because I think work is important.”

Okoroafor is one of thousands of middle-earners able to retire in their 40s with no mortgage and £25,000 a year to spend, it was revealed today.

Experts say anyone can “go from broke to never needing to work again” by saving 50 per cent or even 75 per cent of their salary each month.

READ ALSO: Family Finance: Are You Guilty Of Financial Infidelity?

These ‘super-savers’ then invest it in property and low-risk shares for ten to 20 years and bank the profits every year.

The Holy Grail for anyone who wants to leave work before 65 is saving – because if you want a scatter-cash lifestyle then you will pay for it in many more years at work.

Many take their inspiration from the 5:2 diet, meaning for full five days of the week, they do not spend a penny only allowing themselves to have any outlays on the other two days.

London accountant Barney Whiter, a married dad-of-3 from Farnham, Surrey, walked away from work at 43 by saving half his annual salary after tax.

He then invested all of it in low-risk stock market funds and shares, bringing in up to 12 per cent return every year for 19 years while also paying down his mortgage.

READ ALSO: 5 Surefire Tips to Boost Your Family’s Financial Health This Year

A big house, eating out, expensive holidays, new cars, cable TV and non-essential shopping were all banned so the Whiter family could stick to their £24,000-a-year budget for all spending.

Frugal Whiter made sure he built up a net worth of 25 times his annual spend – £625,000 – in savings and investments.

And the result was retirement around 20 years before his colleagues, which he said “is the best thing since slice bread.”

He told The Times: “If you can save 50 per cent of your take-home pay, it will take 19 years to go from broke to never needing to work again. If you can save 75 per cent, it will take seven to eight years.”

“You need to have the mentality of a marathon runner or triathlete and be able to delay gratification. For most people, money is leaking out of their life like a bucket shot full of holes.”

There is an army of super-savers in the UK, many gaining inspiration from U.S. and British websites that advise on how to become mortgage-free early.

More than 100,000 people are said to be using blogs produced by FIRE proponents including Mr Whiter, who calls himself ‘The Escape Artist’.

Earlier this year, more than 900 people tried to get into a London pub to hear a talk about the formula, spearheaded by Canadian, Peter Adeney who retired at 30.

Mr Adeney’s blog, ‘Mr Money Moustache’ gives people a step-by-step guide to retiring in a decade or less.

Mr Whiter threw all his energy behind his plan to retire in his forties.

He drove a battered second hand Skoda for years and cut spending to the bone while his children, now teenagers, grew up but he insists it was all worth it.

He said: “Tasting freedom is the most intoxicating thing and I wouldn’t ever go back to full-time work. I’d rather cut my lifestyle back. My highest value is freedom and self-determination and being able to do what I want to do.”

Credit: Mail online

Photo Credit: Ken Okoroafor